Wednesday, October 21, 2009

Tuesday, October 6, 2009

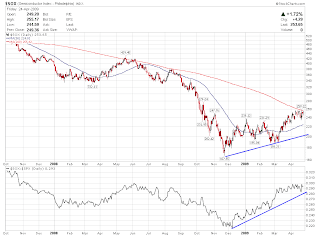

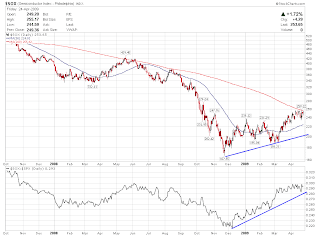

Gold Stocks Are Never Looked Better Before

Take what market offers you, not making predictions what market will do next. Right now, the market says GOLD is breaking out of a 19 months range and many gold stocks are showing favorable chart patterns.

The chart says "Take Them"

The chart says "Take Them"

Saturday, October 3, 2009

A123, Is the Battery More Hype than Hope?

Cleaning Up: Is A123 System’s Explosive Stock-Market Debut The Real Deal?

By Keith Johnson

To judge by the buzz surrounding the initial public offer of battery maker A123 Systems, investors are ready for a ride. A123, which has never turned a profit, just upped both the size and the price of its stock-market listing to almost $400 million. Its shares were priced at $13.50 apiece for the IPO; they jumped to $19.70 in early trading today.

Is this the beginning of the green tech revolution or a reprise of the tech bubble?

Let’s take a look under the hood, as it were. A123, based in Cambridge, Mass., makes batteries that power hybrid and electric cars, among other things. The market for electric cars could be potentially huge, since the U.S. and other big economies want to wean themselves off oil and curb greenhouse-gas emissions.

How huge is anybody’s guess. Actually, it’s A. T. Kearney’s guess—A123 used to use market forecasts from Lux Research, but those were fairly conservative. So since this summer, A123 has been relying on Kearney forecasts of the market for lithium-ion batteries for electric cars: $32 million today, but poised to grow to $21.8 billion in 2015 and $74 billion in 2020.

That might very well be the case. Or it may not—as A123 points out in its prospectus, the world is a fickle place. Oil and gas prices might get cheap and stay there, eroding demand for electric cars. Political will—so important to support the not-yet-cost-competitive electric-car market—could evaporate. Somebody else might invent the next big thing. And so forth.

Actually, as A123 notes, its real fears are more pedestrian. It does a lot of manufacturing in China, where intellectual-property laws are lax. Its rivals are better-funded, and have deeper relationships with carmakers that plan to use the batteries. Staying competitive on costs will be a challenge, especially since China has jumped into the battery business with both feet.

Still, A123 has already landed funding from the federal government’s plan to jumpstart U.S. battery production, a huge vote of confidence. And the company also has its eye on another market: Batteries can be used to store electricity from renewable energy, and countries around the world are already scrambling to add more wind and solar power.

But for investors who remember the dot-com boom, there is one potentially troubling part of A123’s pricey public offering: The company’s proven track record of spending more than it makes. In the first half of 2009, A123 had sales of $43 million and a net loss of $41 million. That followed last year’s net loss of $80.4 million on sales of $68.5 million.

That’s because the company is still spending more to develop the next world-beating battery than it’s making by selling them. Total costs were 1.45 times sales in 2006; 1.78 times sales in 2007; 2.16 times sales in 2008, and 1.93 times sales so far this year. Simply getting bigger won’t solve that.

Investors appear eager to get in on the coming clean-tech revolution; LED-maker Cree had a field day last week with a secondary offering. Time will tell if A123 is the best vehicle to get there

By Keith Johnson

To judge by the buzz surrounding the initial public offer of battery maker A123 Systems, investors are ready for a ride. A123, which has never turned a profit, just upped both the size and the price of its stock-market listing to almost $400 million. Its shares were priced at $13.50 apiece for the IPO; they jumped to $19.70 in early trading today.

Is this the beginning of the green tech revolution or a reprise of the tech bubble?

Let’s take a look under the hood, as it were. A123, based in Cambridge, Mass., makes batteries that power hybrid and electric cars, among other things. The market for electric cars could be potentially huge, since the U.S. and other big economies want to wean themselves off oil and curb greenhouse-gas emissions.

How huge is anybody’s guess. Actually, it’s A. T. Kearney’s guess—A123 used to use market forecasts from Lux Research, but those were fairly conservative. So since this summer, A123 has been relying on Kearney forecasts of the market for lithium-ion batteries for electric cars: $32 million today, but poised to grow to $21.8 billion in 2015 and $74 billion in 2020.

That might very well be the case. Or it may not—as A123 points out in its prospectus, the world is a fickle place. Oil and gas prices might get cheap and stay there, eroding demand for electric cars. Political will—so important to support the not-yet-cost-competitive electric-car market—could evaporate. Somebody else might invent the next big thing. And so forth.

Actually, as A123 notes, its real fears are more pedestrian. It does a lot of manufacturing in China, where intellectual-property laws are lax. Its rivals are better-funded, and have deeper relationships with carmakers that plan to use the batteries. Staying competitive on costs will be a challenge, especially since China has jumped into the battery business with both feet.

Still, A123 has already landed funding from the federal government’s plan to jumpstart U.S. battery production, a huge vote of confidence. And the company also has its eye on another market: Batteries can be used to store electricity from renewable energy, and countries around the world are already scrambling to add more wind and solar power.

But for investors who remember the dot-com boom, there is one potentially troubling part of A123’s pricey public offering: The company’s proven track record of spending more than it makes. In the first half of 2009, A123 had sales of $43 million and a net loss of $41 million. That followed last year’s net loss of $80.4 million on sales of $68.5 million.

That’s because the company is still spending more to develop the next world-beating battery than it’s making by selling them. Total costs were 1.45 times sales in 2006; 1.78 times sales in 2007; 2.16 times sales in 2008, and 1.93 times sales so far this year. Simply getting bigger won’t solve that.

Investors appear eager to get in on the coming clean-tech revolution; LED-maker Cree had a field day last week with a secondary offering. Time will tell if A123 is the best vehicle to get there

Thursday, October 1, 2009

Wednesday, September 30, 2009

Went long AONE

Whether the market tops out soon or it will continue to march higher is in anyone's guess ...

Another distribution day (minor) today is added on major indexes.

Current distribution count, Nasdaq: 2; DOW: 5; NYSE: 3; SP500: 3.

To throw the market to correction, we need to see more distribution days and growth stocks sold on volume. Until I see that happens, I continue to hold my long positions, which are acting constructively so far.

Monday, September 28, 2009

Tuesday, September 22, 2009

Growth Stocks Are Outperforming ... Which Bodes Well For Continued Rally

Continued with the Saturday's post, Play What the Market Offers, here are more buys

GOLD stocks:

Commodities:

Chinese Stocks/Pollution Control:

GOLD stocks:

Commodities:

Chinese Stocks/Pollution Control:

Saturday, September 19, 2009

Monday, August 17, 2009

Tuesday, August 4, 2009

Saturday, August 1, 2009

Keep It Simple, Sit with Your Gains

The Market

let's keep this market comments short. There has not been any material change since the market follow through on July 13.

The philosophy of my trading has not been focused on trying to guess where the market is going to do next, but rather trying to understand what the market is currently doing.

I take cues from the basic law of supply/demand. News events, Market comments from Wall Street, to me, are mostly noise. The economic indexes are all lagging indicators.

The market could top out in a week or next day, but until it clearly tells me so, I continue to hold my top gainers.

Remember the big money is made by sitting, not by trading. This is exactly what I did last week. I only made two trades, initiated a buy on UTA, sold half of CISG to lock in partial gains.

Let's focus on the big pictures,

Let's watch what the market will bring us next week.

The Port

There is little action from me other than watching my core holdings.

BIDU

BIDU continues to act as the de facto leader of the Chinese market. With the Chinese stock market leads the world market to recovery, there is little doubt where the money is going. The price/volume action is very constructive. The fundamental side of the story supports the price higher.

Hold for now unless there is a material change of the market direction.

CISG

This little thin Chinese insurance company has enjoyed an enormous run since I entered my first buy on July 15. The high volume sell off last Friday could mean it could use some rest. Sell half.

GMCR

Could this little coffee maker be another Taser or HANS?

Beautiful stock! HOLD!

NTES

NTES is the strongest stock (with PWRD) in Chinese gaming market. In face of some Chinese gaming stocks broken down last week (CYOU, SNDA), NTES continues to hold up rather well. Earnings will be out in two weeks.

Hold!

EJ and CHLN

HOLD

UTA

Another Chinese stock broke out a two month trading range on 07.28.2009. Group peer includes Ctrip and Priceline. Last quarter sales growth 72%, EPS growth: 75%. The stock is on the thin side with average trading volume of 400K.

Bought the first position on July 28, 2009 with pivot buy of 12.70.

let's keep this market comments short. There has not been any material change since the market follow through on July 13.

The philosophy of my trading has not been focused on trying to guess where the market is going to do next, but rather trying to understand what the market is currently doing.

I take cues from the basic law of supply/demand. News events, Market comments from Wall Street, to me, are mostly noise. The economic indexes are all lagging indicators.

The market could top out in a week or next day, but until it clearly tells me so, I continue to hold my top gainers.

Remember the big money is made by sitting, not by trading. This is exactly what I did last week. I only made two trades, initiated a buy on UTA, sold half of CISG to lock in partial gains.

Let's focus on the big pictures,

- The housing stocks are in the bottoming process, which bode well for housing recovery. (XHB/ITB)

- 200MA of Major indexes (Nasdaq, S&P500) are flattening and curving up. With the golden cross of 50MA/200MA in June, a classic uptrend is established.

Let's watch what the market will bring us next week.

The Port

There is little action from me other than watching my core holdings.

BIDU

BIDU continues to act as the de facto leader of the Chinese market. With the Chinese stock market leads the world market to recovery, there is little doubt where the money is going. The price/volume action is very constructive. The fundamental side of the story supports the price higher.

Hold for now unless there is a material change of the market direction.

CISG

This little thin Chinese insurance company has enjoyed an enormous run since I entered my first buy on July 15. The high volume sell off last Friday could mean it could use some rest. Sell half.

GMCR

Could this little coffee maker be another Taser or HANS?

Beautiful stock! HOLD!

NTES

NTES is the strongest stock (with PWRD) in Chinese gaming market. In face of some Chinese gaming stocks broken down last week (CYOU, SNDA), NTES continues to hold up rather well. Earnings will be out in two weeks.

Hold!

EJ and CHLN

HOLD

UTA

Another Chinese stock broke out a two month trading range on 07.28.2009. Group peer includes Ctrip and Priceline. Last quarter sales growth 72%, EPS growth: 75%. The stock is on the thin side with average trading volume of 400K.

Bought the first position on July 28, 2009 with pivot buy of 12.70.

Friday, July 24, 2009

Keep/Add to the Winning Position, Sell the Laggard

Hello from Las Vegas. Las Vegas is hit with blistering wave of summer heat. It is hot hot hot. Folks look really sexy on the street ...

Market closed the last Friday with modest loss. The fact that a few big high profile stocks got hit hard combined with overbought market condition did not bring down much the big board shows how much stronger the underlying market is.

The market breath is in lock step with the big board moving higher.

Market is overbought in short term. In strong bull market, overbought condition is not the reason to sell winning positions.

My Port

BIDU

GMCR

NTES

CISG

EJ

CHLN

The following positions are sold,

CYOU

CYOU is too sloppy. The wide and loose price action is not something I like to see. Sell the position, move the fund to cash and other better performing stocks.

FUQI

FUQI offered the secondary essentially diluting the share value. There is no information on how much the secondary is priced. Sell now to move fund to cash.

In retrospect, I probably should keep 50% of the winning position.

ARST

The action is too sloppy. Sell!

Market closed the last Friday with modest loss. The fact that a few big high profile stocks got hit hard combined with overbought market condition did not bring down much the big board shows how much stronger the underlying market is.

The market breath is in lock step with the big board moving higher.

Market is overbought in short term. In strong bull market, overbought condition is not the reason to sell winning positions.

My Port

BIDU

GMCR

NTES

CISG

EJ

CHLN

The following positions are sold,

CYOU

CYOU is too sloppy. The wide and loose price action is not something I like to see. Sell the position, move the fund to cash and other better performing stocks.

FUQI

FUQI offered the secondary essentially diluting the share value. There is no information on how much the secondary is priced. Sell now to move fund to cash.

In retrospect, I probably should keep 50% of the winning position.

ARST

The action is too sloppy. Sell!

Monday, July 20, 2009

A Day of Strength in Leaders

I came across this video and found it extremely interesting. Speaking of credibility problem, you think America is not full of it?

A solid day for CANSLIM investors. The theme of China is playing out. Many growth stocks are breaking out from the consolidation area. This bodes well for the continued up move of the big board.

Nasdaq Composite has been up for nine days in a row. A little rest is expected and should be welcomed.

IBD 100 index added 2.5%; IBD 85/85 rose 2.6%, all well above the major indexes. May leading stocks finally outshine the major indexes and lead the market higher? Time will tell ...

More leading stocks broke out and my soldiers are put on line

FUQI (Retail/Whlsle-jewelry, Chinese ADR)

BIDU (Internet-content, Chinese ADR)

EJ (Real Estage Operations, Chinese ADR)

GMCR (Retail/whlsle-food)

NTES (internet-content, Chinese ADR)

ARST (computer Sftwr-security)

CISG (Insurance-brokers, Chinese ADR)

CYOU (Internet-content, Chinese ADR)

WATG (Auto/truck-original Eqp)

TSRA

CHLN

A few other stocks, which posted solid gains, are on my watch list. Not surprisingly, they are all Chinese ADRs.

PWRD

VIT

UTA

Two stocks failed the breakout and I have cut loss after I bought them,

VPRT, TLEO.

A solid day for CANSLIM investors. The theme of China is playing out. Many growth stocks are breaking out from the consolidation area. This bodes well for the continued up move of the big board.

Nasdaq Composite has been up for nine days in a row. A little rest is expected and should be welcomed.

IBD 100 index added 2.5%; IBD 85/85 rose 2.6%, all well above the major indexes. May leading stocks finally outshine the major indexes and lead the market higher? Time will tell ...

More leading stocks broke out and my soldiers are put on line

FUQI (Retail/Whlsle-jewelry, Chinese ADR)

BIDU (Internet-content, Chinese ADR)

EJ (Real Estage Operations, Chinese ADR)

GMCR (Retail/whlsle-food)

NTES (internet-content, Chinese ADR)

ARST (computer Sftwr-security)

CISG (Insurance-brokers, Chinese ADR)

CYOU (Internet-content, Chinese ADR)

WATG (Auto/truck-original Eqp)

TSRA

CHLN

A few other stocks, which posted solid gains, are on my watch list. Not surprisingly, they are all Chinese ADRs.

PWRD

VIT

UTA

Two stocks failed the breakout and I have cut loss after I bought them,

VPRT, TLEO.

Friday, July 17, 2009

Thursday, July 16, 2009

Wednesday, July 15, 2009

The Market Follow Through Negates the Short Term Head and Shoulders Top

The market resumed its uptrend on Monday.

The high volume surge today of major indexes negates the short term head and shoulders top formation. S&P500 came back above the neckline after it lived under it for 4 trading days.

The Nasdaq Composite, which is the leading index, broke above the 5 week flag formation on high volume.

The action in leading stocks overall continues to be muted. IBD 100 has been lagging in the entire rally from March 12 follow through. Though if bought right, profits can be made handsomely. Strong bear market rally can be very profitable.

Here are a few good ones broke above the trading range.

BIDU, TLEO, STAR, EJ.

Here are the top leading stocks continue to form the second stage bases,

GMCR, NTES, SNDA, VPRT, ARST, NFLX, CYOU, PWRD, AMZN, STEC, RVBD ...

The high volume surge today of major indexes negates the short term head and shoulders top formation. S&P500 came back above the neckline after it lived under it for 4 trading days.

The Nasdaq Composite, which is the leading index, broke above the 5 week flag formation on high volume.

The action in leading stocks overall continues to be muted. IBD 100 has been lagging in the entire rally from March 12 follow through. Though if bought right, profits can be made handsomely. Strong bear market rally can be very profitable.

Here are a few good ones broke above the trading range.

BIDU, TLEO, STAR, EJ.

Here are the top leading stocks continue to form the second stage bases,

GMCR, NTES, SNDA, VPRT, ARST, NFLX, CYOU, PWRD, AMZN, STEC, RVBD ...

Saturday, April 25, 2009

Market is Under Character Change, Time for Growth Investors Could Be (Is) Coming

Details will be added, but here is the outline

1. Section Rotation Model

2. Stan Weinstein's Stage Analysis

3. the Market in 1938 and today

William O'Neil's radio interview on 04.21.2009

3. Leading stocks are building bases; Breakouts are sticking

4. Market is due for consolidation

1. Section Rotation Model

2. Stan Weinstein's Stage Analysis

3. the Market in 1938 and today

William O'Neil's radio interview on 04.21.2009

3. Leading stocks are building bases; Breakouts are sticking

4. Market is due for consolidation

- the Market is very overbought in intermediate time frame

- Bullish Percentage Index is reaching bear market extreme

- the Market will show its card in the next pull back

Subscribe to:

Posts (Atom)