1. Section Rotation Model

2. Stan Weinstein's Stage Analysis

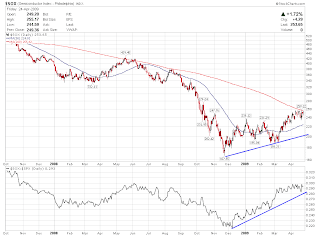

3. the Market in 1938 and today

William O'Neil's radio interview on 04.21.2009

3. Leading stocks are building bases; Breakouts are sticking

4. Market is due for consolidation

- the Market is very overbought in intermediate time frame

- Bullish Percentage Index is reaching bear market extreme

- the Market will show its card in the next pull back